When most people hear “life insurance,” they think of one thing: a payout after you’re gone.

But there’s a type of policy that can help you build wealth while you’re alive—and it could save you a serious amount in taxes along the way.

Let’s talk about Indexed Universal Life insurance, or an IUL for short. If you’re looking for tax advantages, long-term flexibility, and the ability to leave a legacy, an IUL might be worth a closer look.

Want to know more about permanent vs term life polices? Read Here

What Is an IUL, Really?

An Indexed Universal Life policy is a permanent life insurance policy—meaning it doesn’t expire like term life does. But unlike whole life insurance, IULs offer more flexibility and the potential to grow cash value based on the performance of a stock market index, like the S&P 500.

But here’s the key:

You’re not actually investing in the market. Your cash value grows based on how the market index performs, but your principal is protected. So if the index goes down, you don’t lose money—your growth is simply zero for that period (not negative).

Meanwhile, your policy also builds cash value that you can access later. And that’s where the tax benefits come in.

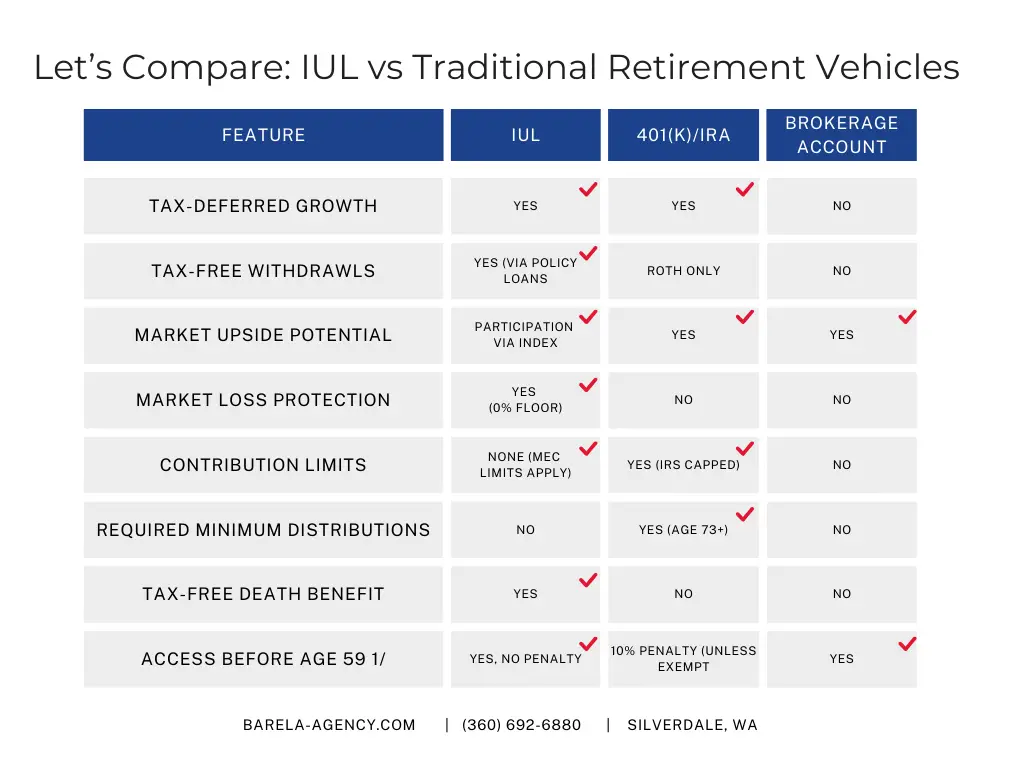

Tax Benefits of an IUL: What Makes It So Powerful?

- Tax-Deferred Growth

Just like a 401(k) or IRA, your cash value grows tax-deferred inside the policy. That means you don’t pay taxes on gains each year—allowing your money to grow faster over time.2. Tax-Free Policy Loans

Once your cash value has grown enough, you can borrow against the policy—and those loans are generally tax-free if the policy stays active and is properly managed.3. No Required Minimum Distributions (RMDs)

Unlike 401(k)s and IRAs, there are no age-related withdrawal rules. You control when and how you access your money.4. Tax-Free Death Benefit

The policy provides a tax-free death benefit for your beneficiaries, useful for estate planning, debt payoff, or legacy giving.

Real-World Example: How It Works

Let’s say you’re 40 years old and start funding an IUL policy with $500/month. Over time, your cash value grows based on a market index, and by retirement, you’ve built a nice nest egg—without market risk and without paying taxes each year on gains.

In your 60s or 70s, you could borrow against your policy to supplement retirement income—tax-free—while keeping your other taxable accounts untouched for a little longer.

If something happens to you, your family gets a tax-free payout.

Who Should Consider an IUL?

An IUL isn’t for everyone—but it’s a great fit for:

– Business owners or self-employed individuals looking for tax-advantaged growth

– High-income earners who’ve maxed out their qualified retirement plans

– Families who want to build wealth while protecting loved ones

– People planning for long-term care or estate needs

And frankly, anyone who’s tired of watching the IRS take a bigger bite every year.

Common Misconceptions About IULs

“I thought life insurance was just for death protection.”

Not anymore. Modern policies are designed for living benefits too.

“Aren’t these expensive?”

Only if they’re structured wrong. A properly designed IUL focuses on cash value accumulation—not oversized commissions or inflated death benefits.

“Isn’t this just a fancy investment?”

Nope. It’s insurance first, with guaranteed floors and tax perks most investment accounts can’t offer.

Frequently Asked: Are There Contribution Limits on an IUL?

Short answer: No—but there’s a catch.

Unlike 401(k)s and IRAs, Indexed Universal Life policies don’t have strict IRS contribution caps. You can fund them far more aggressively—but you have to do it strategically.

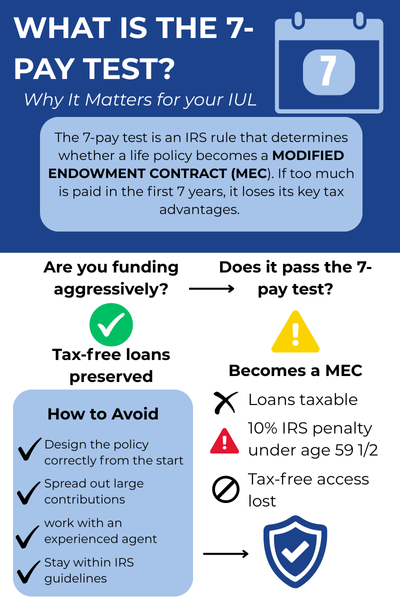

If you overfund the policy too quickly, it can become a Modified Endowment Contract (MEC). Once that happens, the policy loses its most powerful advantage: tax-free loans and withdrawals.

To avoid this, IULs are typically structured to maximize cash accumulation while staying within IRS rules under Section 7702. This often involves:

– Adjusting the death benefit relative to the premium

– Spreading out larger contributions over time

– Following what’s called the 7-pay test

You can contribute significantly more than a traditional retirement plan—just make sure it’s designed correctly.

Build Wealth Without Uncle Sam Sitting in the Front Seat

There’s no shortage of tools for growing your money—but very few offer the kind of control, protection, and tax flexibility that an IUL does.

If you’re looking for a smarter way to protect your family, grow your savings, and reduce future tax burdens, this might be worth a conversation.

Want to know if an IUL makes sense for your situation? Reach out today. I’ll walk you through it with full transparency—no pressure, no jargon, and no guessing.