Starting a business is exciting — but it also comes with a lot of responsibility. One of the most important steps you can take is making sure your investment is protected from the start. Insurance isn’t just a formality; it’s peace of mind for all the hard work, time, and money you’re putting into your dream. Whether you’re opening a storefront, running a business from home, or offering a new service, here’s a simple checklist to help you cover your bases.

Types of Business Insurance Coverages First, think about general liability insurance. It’s usually the first kind of policy new businesses pick up. It protects you if someone gets hurt or if you accidentally damage someone’s property. Even small accidents can lead to big costs, so it’s smart to have this from the start.

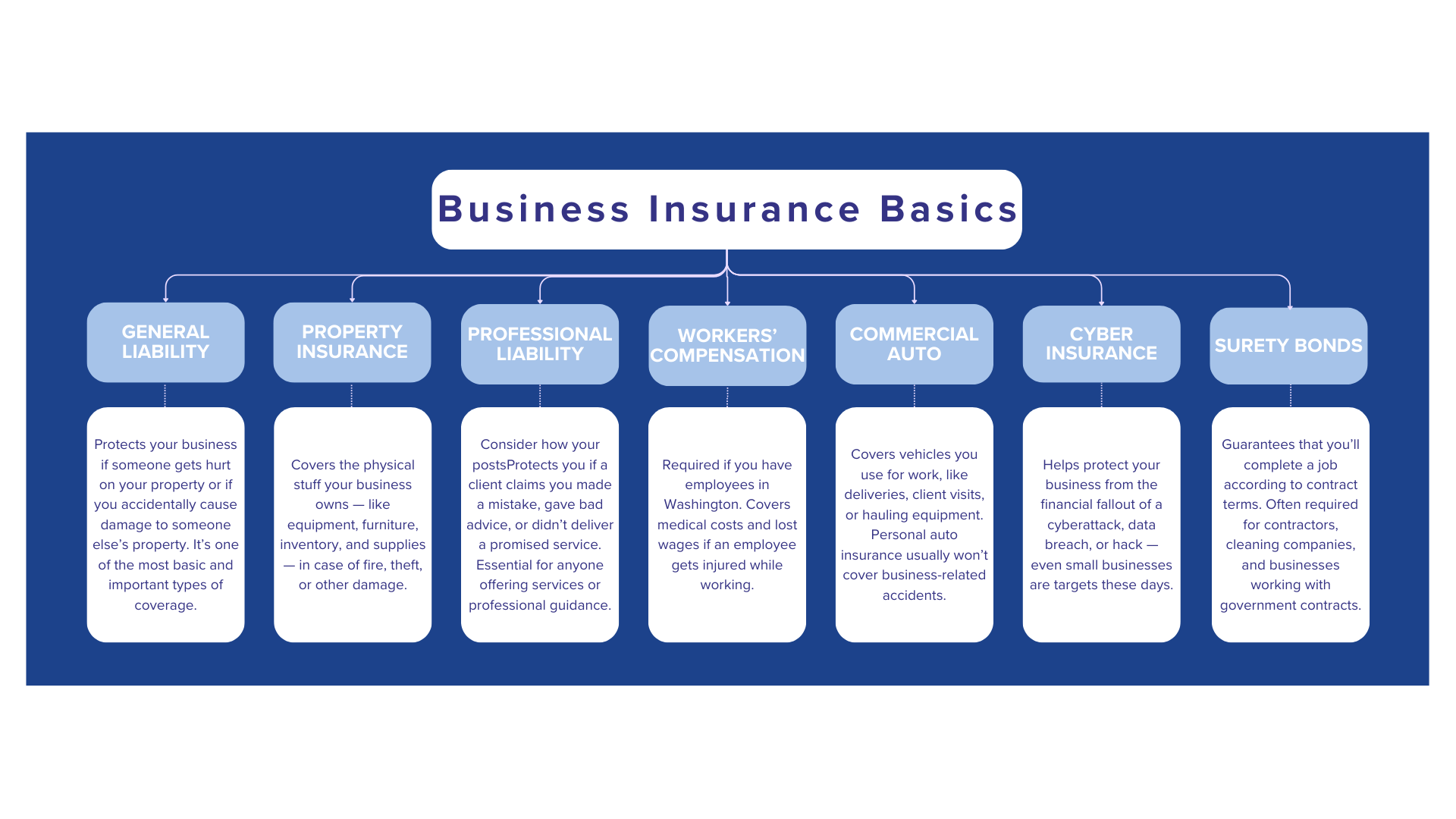

First, think about general liability insurance. It’s usually the first kind of policy new businesses pick up. It protects you if someone gets hurt or if you accidentally damage someone’s property. Even small accidents can lead to big costs, so it’s smart to have this from the start.

If you have anything physical — like inventory, furniture, supplies, or equipment — business property insurance is a must. It covers you if there’s a fire, theft, or another unexpected problem that could wipe out what you’ve built.

If you offer any services or advice, you’ll want professional liability insurance too (sometimes called errors and omissions coverage). It protects you if a client claims you made a mistake that cost them money — which happens more often than you might think, even when you do everything right.

If you have employees, Washington State requires you to have workers’ compensation insurance. It covers medical expenses and lost wages if someone gets hurt at work. Even if you only have one employee, it’s required by law.

If you use a vehicle for business — deliveries, job sites, client meetings — you’ll probably need a commercial auto policy. Most personal auto policies don’t cover business use, even if it’s just occasional.

Today, cyber risks are everywhere, and small businesses are just as much a target as big ones. If you store customer information or take online payments, cyber liability insurance is a smart layer of protection against hacks and data breaches.

And depending on what type of work you do, you might need a bond. A lot of contractors, cleaning businesses, and specialty services need to be bonded to legally operate or win bigger jobs. A bond is basically a guarantee you’ll finish the work you’re hired for.

How Much Does Business Insurance Cost in Washington?

Business insurance can actually be pretty affordable, especially when you think about what it protects. Most small businesses in Washington pay somewhere between $500 and $2,500 a year for basic coverage. It really depends on what you do, how big your operation is, and the kind of coverage you need. A quick conversation with an agent can usually give you a good ballpark figure.

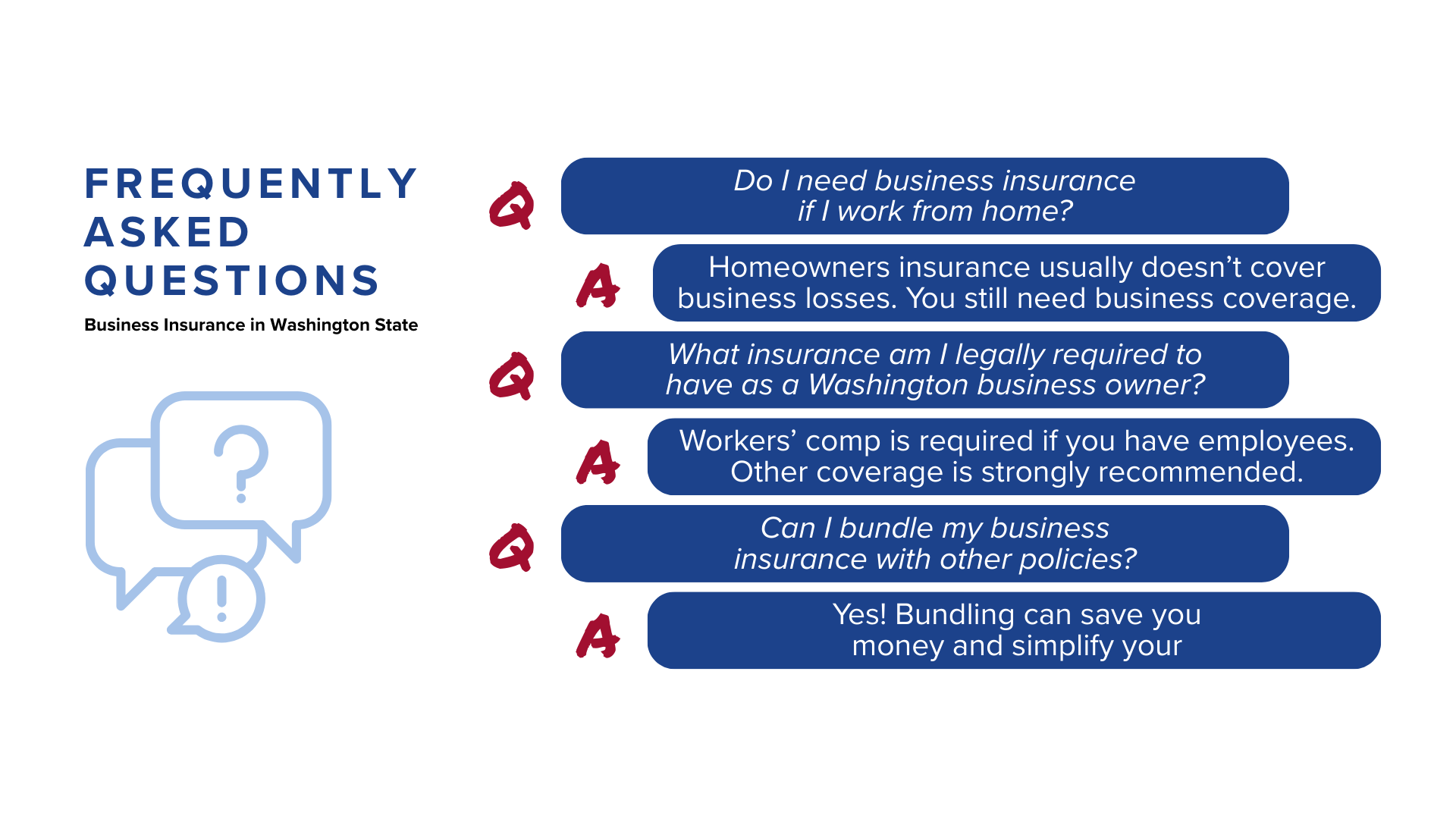

Quick FAQ for New Business Owners

One of our clients, a bakery owner here in Silverdale, came to us right after opening. We helped her set up a custom policy that bundled her business property, general liability, and commercial auto coverage. A few months later, a small equipment leak caused water damage in her shop. Thanks to the right coverage, she avoided a big financial hit — and kept her business running without missing a beat.

One of our clients, a bakery owner here in Silverdale, came to us right after opening. We helped her set up a custom policy that bundled her business property, general liability, and commercial auto coverage. A few months later, a small equipment leak caused water damage in her shop. Thanks to the right coverage, she avoided a big financial hit — and kept her business running without missing a beat.

Let’s Protect Your Business from Day One

Building a business is a big deal. Protecting it doesn’t have to be complicated. Reach out to The Barela Agency for a free, no-pressure consultation. We’ll help you find the right coverage and make sure you’re set up for success.